On February 1, 2018, the Internal Revenue Service issued a warning to taxpayers to watch out for fake emails or websites impersonating the IRS and trying to steal your personal information as well as aggressive phone scammers demanding immediate payment.

Phishing schemes have been around for a while and continue to get more sophisticated. Tax payers should know that the IRS will never initiate contact with you via e-mail, text messages, or social media with a request for personal information or financial data. Do not reply or click on any links in a suspected email. Instead, forward the email to phishing@irs.gov and delete your original email without further action.

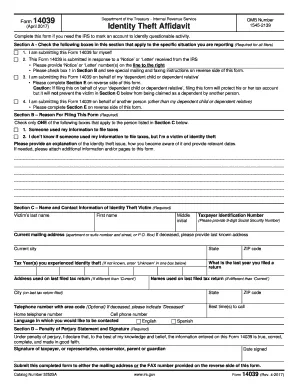

The following email is a phishing sample found on irs.gov/uac/Report-Phishing. Note how the body of the e-mail simulates the real IRS website (graphics, colors, names). Also note the incorrect spelling (founds instead of funds) and grammar (‘some of your money were lost’), and, of course, the link that will try to steal your personal information.

Remember to always verify any correspondence from the IRS, your tax filing company, or human resources department before acting on any request for information.

Aggressive phone scammers will use fake names and badge numbers to sound legitimate. They can alter the caller ID to make it look like the IRS. They may tell you that you owe money to the IRS and must pay immediately to avoid penalties or even jail time. They will ask for payment in the form of a wire transfer, preloaded debit card, or even a store card such as Amazon. Do not fall for their pressure techniques. Hang up the ‘urgent’ phone call and report it to the IRS.

For more information, visit the IRS.gov website and enter “scam” in the search menu.

800-585-9888

800-585-9888