7 Alarming Signs That Your Revocable Living Trust Has Become Outdated

July 18, 2025•6 min read

Introduction:

Estate planning isn't just a one-and-done task; it should evolve with your life, family, and the law. If your revocable living trust was created before 2011, chances are it's no longer optimized for today's tax laws or family dynamics. Laws have shifted dramatically, especially with the introduction of portability, making older A-B Trusts potentially obsolete and even harmful.

An outdated trust could burden your family with extra taxes, administrative headaches, and restricted access to inherited wealth. This article explores what's changed, why it matters, and what steps you should take now.

What Is a Revocable Living Trust?

A revocable living trust is a legal document that lets you control your assets during your lifetime and specify how they should be distributed after death – all without going through probate. You can alter, amend, or revoke the trust at any time while you're alive.

Key Advantages for Families

- Avoids probate, saving time and money

- Keeps your affairs private

- Allows you to name trustees and successors

- Provides flexibility in managing incapacity

- Helps in multi-state property management

The Rise and Fall of Revocable Trusts with A-B Provisions

What Is an A-B Trust Structure?

An A-B Trust splits into two parts to capture both spouses' exemptions after the first spouse dies:

- The A Trust (Marital Trust): Holds the surviving spouse's share.

- The B Trust (Credit Shelter Trust): Contains the deceased spouse's exempt assets.

Why They Were Essential Before 2011

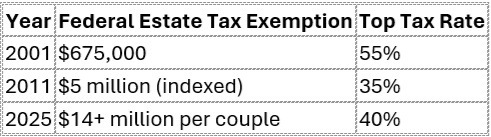

Before 2011, the estate tax exemption wasn't portable. If unused upon the first death, it was lost. To retain it, couples had to use A-B Trusts to "lock in" the deceased spouse's exemption.

How Tax Law Changes Made A-B Trusts Obsolete

Thanks to the 2010 Tax Relief Act and later permanent adoption in 2013, the IRS allowed portability of the estate tax exemption between spouses. That means the surviving spouse can inherit any unused portion of the deceased spouse's exemption via the DSUE (Deceased Spouse Unused Exemption).

A-B Trusts are now unnecessary for most Americans due to today's $28M+ combined exemption for married couples.

Consequences of an Outdated Revocable Living Trust

Loss of Second Step-Up in Basis

Assets held in a Credit Shelter Trust don't receive a second step-up in basis upon the surviving spouse's death. That means your children could face large capital gains taxes when they sell inherited assets.

Restricted Spousal Access to Trust Assets

Even if the surviving spouse is the trustee, access to B Trust assets is often limited to HEMS (Health, Education, Maintenance, Support) standards. In contrast, a modern trust allows full access and control while still preserving the exemption.

Increased Administrative Duties

Credit Shelter Trusts come with burdensome legal responsibilities:

- Separate trust tax returns (IRS Form 1041)

- Annual accounting to beneficiaries

- Compliance with Florida's Trust Code, including:

- § 736.0813, Fla. Stat. – Annual report requirements

- § 518.11, Fla. Stat. – Prudent investment mandates

Exposure to Capital Gains Tax

Without a basis adjustment, appreciated assets in the B Trust result in a taxable gain upon liquidation. That means less inheritance for your beneficiaries.

Key Legal Responsibilities for Florida Trustees

Compliance and Fiduciary Duties

Florida trustees must:

- Separate personal and trust assets

- Maintain accurate records

- Act in good faith and in the best interest of all beneficiaries

IRS Reporting Requirements

- IRS Form 1041 must be filed annually if trust income exceeds $600.

- Strict accounting rules apply to ensure transparency and proper distributions.

Warning Signs Your Trust May Be Outdated

- Created or last reviewed before 2011

- Includes automatic Credit Shelter Trust funding

- Lacks portability or DSUE references

- Surviving spouse has limited access to trust assets

- You never filed Form 706 after your spouse's death

- Inflexible terms for blended families

- Heirs face capital gains tax on inherited assets

If any of these apply, it's time for an urgent review.

Modern Alternatives to Outdated Trust Structures

Portability-Friendly Trust Design

Today's trusts can preserve both tax exemptions without dividing assets unnecessarily. This simplifies management and preserves tax efficiency.

Customization for Blended Families

New planning techniques include:

- QTIP trusts for second spouses

- Lifetime beneficiary protections

- Conditional distributions based on remarriage or blended heirs

Tax-Efficient Planning Tools

- Disclaimer Trusts offer flexibility

- SLATs (Spousal Lifetime Access Trusts) and IDGTs (Intentionally Defective Grantor Trusts) for large estates

- Filing Form 706 to elect portability—even late, with IRS approval

FAQs: Is Your Revocable Living Trust Outdated?

- Do I still need an A-B Trust in 2025?

Only if your estate is well over $14 million. Most families can now rely on portability instead. - What is a step-up in basis, and why does it matter?

It adjusts the value of inherited property to its market value at death, minimizing capital gains tax when sold. - What is the DSUE amount?

It's the Deceased Spouse's Unused Exemption—a portable estate tax exemption transferred to the surviving spouse. - Can I fix an outdated trust without starting over?

Yes. You can amend or fully restate your trust depending on its condition and the needed changes. - What happens if I never filed Form 706?

You may still be eligible for a late portability election—consult with a tax attorney immediately. - What are HEMS standards?

HEMS stands for Health, Education, Maintenance, and Support, often used to restrict distributions to beneficiaries.

Conclusion: Don't Let an Old Trust Hurt Your Legacy

If your revocable living trust hasn't been updated in over a decade, it could be doing more harm than good. Outdated A-B Trust structures, once essential, are now often counterproductive due to changes in tax law. The good news? With help from a qualified estate planning attorney, you can modernize your plan, reduce taxes, and simplify your family's financial future.

Take the time now to review and update your trust. Your heirs will thank you.

About the Author

Michael T. Koenig, CFP®, J.M., is the Founding Partner of FirsTrust, LLC. With over 35 years of experience as a professional financial advisor, Michael candidly shares his insights to promote truth and transparency for financial service consumers. He holds a bachelor's degree in psychology from the University of Maryland, a master's certificate in finance from George Washington University, a Juris Master of Law degree from Florida State University College of Law, and the CFP® Certified Financial Planner™ designation.

At FirsTrust, clients are served by a FinancialTeam of experienced financial specialists who have sworn a fiduciary oath to preserve their objectivity by refusing to accept the industry's typical kick-backs and marketing incentives.

Cal 1-800-585-9888 to request a free review of your estate plan. We aren't lawyers, insurance salesmen or commission-paid financial planners: no cost and no sales pitch.